Smith County officials debate property tax rate increase

Published 7:00 pm Tuesday, June 18, 2019

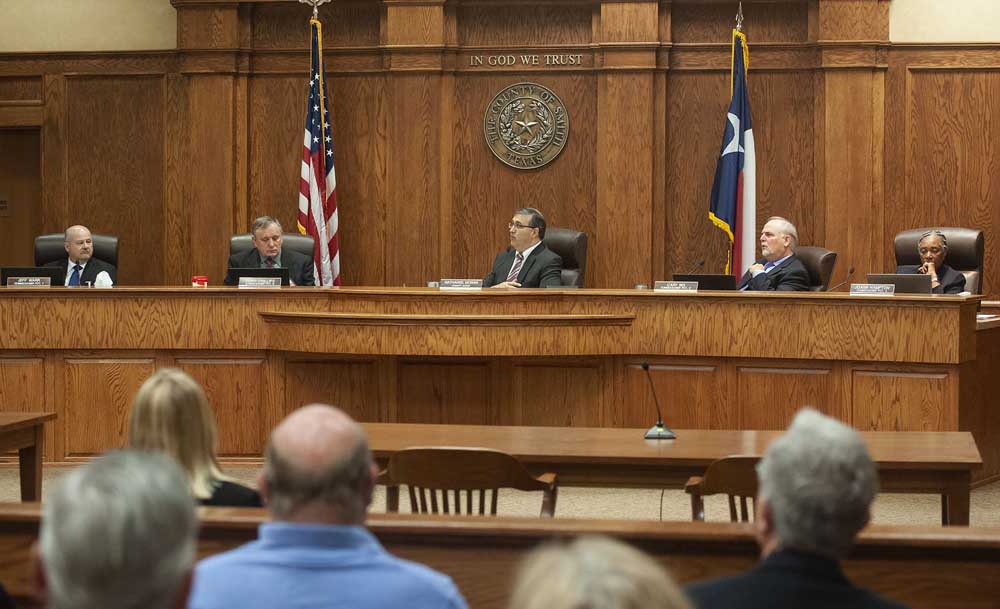

- The Smith County Commissioners Court members as seen during a previous meeting. Court members are are (from left) Commissioner Jeff Warr, Commissioner Terry Phillips, Judge Nathaniel Moran, Commissioner Cary Nix and Commissioner JoAnn Hampton. (Sarah A. Miller/Tyler Morning Telegraph/File)

Smith County officials are looking at whether to raise property tax bills in the upcoming fiscal year to pay for new spending related to law enforcement and employee raises, among other things.

Smith County Judge Nathaniel Moran proposed a tax rate increase to the Commissioners Court on Tuesday morning during an annual budget workshop in which each of the county’s department heads discussed what they need.

This was a preliminary step in making a budget for fiscal year 2020, which starts Oct. 1. The Commissioners Court will go through several more steps before deciding on an annual budget and a property tax rate.

In the current version of the draft working budget, Moran has proposed a tax rate of 34.5 cents per $100 of appraised property value. The most recent rate, for taxes on the 2018 property values, was 33.7311 cents. That was an increase over the previous year of 33 cents.

The draft working budget proposes 1.5 percent cost-of-living raise for county employees, excluding the county judge and members of the Commissioners Court; $3,500 raises for three elected officials, the County Clerk, the District Clerk, and the Treasurer; travel allowance increases for the justices of the peace; and pay supplements for county judges and district judges.

Additionally, Moran has proposed a range of spending items, including upgrading the facility for the Road and Bridge Department, hiring Spanish interpreters for prosecuting a death penalty case, hiring three new people in the information technology department, and new spending in some constable offices.

In the Smith County Sheriff’s Office, the draft working budget proposes creating several new positions, including eight detention officers for the jail, two patrol deputies, an administrative sergeant, a communications supervisor, a telecommunicator, a crime scene investigator, and a crime scene technician.

“The fiscal effect of bringing all these people in is well over $1.5 million,” Moran told the court about the sheriff’s office. However, he said “public safety is the No. 1 responsibility for the county and we have to make an investment in the sheriff’s office. I’ve proposed the best way I know how to do that.”

The Commissioners Court did not make a decision on the tax rate Tuesday. Should the Commissioners Court vote to raise more revenue than the county took in from 2018 property values, the county will need to post formal notice to taxpayers in the local newspaper and hold meetings that allow for further public comment.

Commissioner Terry Phillips said he made a commitment when he ran for office not to vote for a tax rate increase.

“I don’t think this is a decision we make today,” Commissioner JoAnn Hampton added. “We need some time to mull over it.”

Commissioner Jeff Warr said candidates should be careful not to promise they won’t raise taxes when elected because they don’t know what could come up to require increases.

“If it’s going to be public safety, and somebody is going to be mad at me, then they’re just going to have to deal with that,” he said of how he would vote.

Moran added: “It’s a really big decision and not one that we need to make here today.”

JW McNay contributed to this report.

TWITTER and INSTAGRAM: @_erinmansfield

- July 23: Budget workshop

- July 31: Budget submitted to County Clerk

- Aug. 6 & 13: Public hearings held on budget

- Aug. 27: Commissioners Court adopts budget and tax rate

- Oct. 1: Budget goes into effect

A previous version of this story misstated which elected officials may get raises. The $3,500 raises being considered are only for the County Clerk, the District Clerk, and the Treasurer.