What to know about school bonds being proposed in Smith County

Published 5:45 am Saturday, May 7, 2022

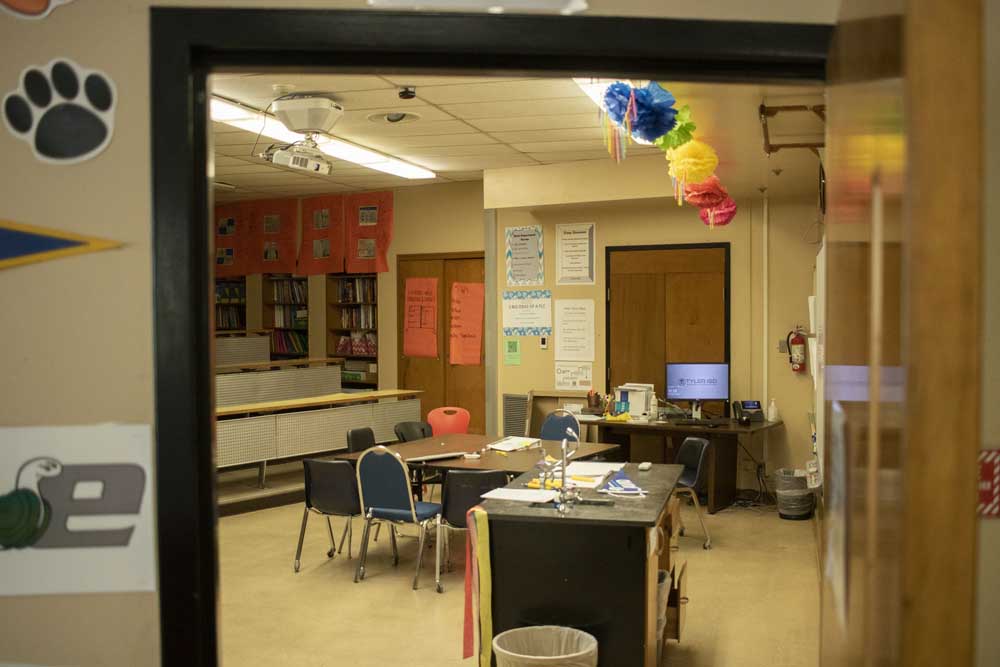

- PHOTOS: Inside of 55-year old Hubbard Middle School

Three school districts in Smith County are asking voters to consider multimillion-dollar bond packages for campus improvements.

The Tyler Morning Telegraph asked the districts to answer some key questions about the propositions and also compiled previous coverage to inform voters ahead of the May 7 election.

Which districts are proposing bonds and how much is each package?

Tyler ISD: The bond package is $89 million.

Chapel Hill ISD: The bond package totals over $125 million and is made up of two propositions, one for $113 million and another for $12 million.

Bullard ISD: The bond package totals $103 million. Voters will see Proposition A for $82 million and Proposition B for $21 million.

Tyler ISD

The following information is based on previous Tyler Morning Telegraph coverage and a recent Q&A with Tyler ISD Superintendent Marty Crawford.

How will the bond affect the tax rate if it is passed?

“Tyler ISD has proposed a no tax rate increase referendum of $89 million for voter consideration,” Crawford said. “Even though property values have risen over the last three to four years, the district will lower its tax rate to the lowest taxpayers have seen in the last 14 years.

“What people may not realize is that per Texas law, the district cannot access any additional revenue past 2.5% of any increased assessed property valuation as the state will compress (lower) the maintenance & operations tax rate. In addition, the debt service side of the tax rate will also decrease as appropriate.”

There are exemptions, as well.

“Qualifying disabled veterans and residents who have an over-65 homestead exemption had their taxes frozen when their exemption was granted (unless improvements or additions are made),” the district states on its website.

For more information, call the Smith County Appraisal District at 903-510-8600.

If the bond is passed, what will be built/renovated?

“If approved, the May 2022 package includes the replacement of Hubbard Middle School with a new facility comparable to the middle schools at Boulter, Moore, and Three Lakes, built after voter approval in the 2013 bond,” Crawford said. “This would allow the district to consolidate its middle school feeder patterns into four buildings: Hubbard, Boulter, Moore, and Three Lakes.

“Further, the proposal calls for consideration of the construction of Tyler ISD Early College High School (ECHS) to be located near the Career Technology Center. This would give ECHS its own facility. Currently, ECHS shares space with the RISE Academy for credit and attendance recovery at the A.T. Stewart campus.”

Specifics of each proposed renovation include:

New Hubbard Middle School to replace 55-year-old school:

- Located on current site designed to exact specifications as other middle schools

- 1,200 student capacity

- Updated safety and security features

- Improved traffic flow and designated parking areas

- Meets or exceeds all energy/building codes, ADA, TEA, and UIL requirements

New Early College High School:

- Located next to Tyler ISD Career and Technology Center

- 650+ student capacity

- Cafeteria to be shared with CTC students

- Updated safety and security features

- Dedicated parking areas

- Meets or exceeds all energy/building codes, ADA, and TEA requirements

The district has previously said the 2022 bond is the “last puzzle piece” of a 20-year master facilities plan which began in the early 2000s. With passage of the 2004, 2008, 2013 and 2017 bonds, the district has renovated and rebuilt 22 campuses.

A look back at the most recent previous bonds proposed by the district:

2004: $96 million bond passes to begin replacing elementary schools and build Jack Elementary School

2008: $125 million bond passes to replace five more of the remaining elementary schools

2010: $90 million package fails that would have replaced remaining elementary schools

2013: $160.5 million package passes to finish replacing elementary schools, Boulter and Moore middle schools and saw the construction of Three Lakes Middle School and the Career and Technology Center

2017: $198 million package passes to renovate what is now Tyler Legacy and Tyler High Schools

What happens if the bond does not pass?

“Regardless of the outcome of the May 7 election, as always, Tyler ISD will look at future opportunities for continuous improvement that will best serve the students and staff in its attempt to meet the mission of successful student outcomes,” Crawford said.

What’s the projected timeline?

“Work could start as early as this summer, in either June or July, and if conditions are favorable, both buildings could be ready for students and staff by Christmas of 2023,” Crawford said.

Chapel Hill ISD

Chapel Hill ISD Superintendent Lamond Dean spoke about the two propositions, which could bring renovations and new facilities to the district.

How will the bond affect the tax rate if it is passed?

“The total estimated cost for the proposed bond projects is $125,240,000,” Dean said. “If the bond passes, the current tax for debt services of $0.11 could increase by a maximum of $0.3482¢. However, the recent increases in property values would lower the maximum tax increase.

“For a home valued at $100,000, the itemized proposition increase for Proposition A would be $14.48 per month, and $1.56 for Proposition B. If both propositions are passed, the total amount per month would be $16.04 for a home valued at $100,000. These taxable values are based upon the projected passage of a new $40,000 homestead exemption.”

Qualifying disabled veterans and residents who have an over-65 homestead exemption had their taxes frozen when their exemption was granted (unless improvements or additions are made).

If the bond is passed, what will be built/renovated?

Proposed projects recommended to the Chapel Hill ISD Board of Trustees by the district’s Long Range Facility Planning Committee:

New Junior High $56,654,000: Build a new junior high school on its own campus with adequate acreage, circulation, access, and facilities.

New operations and transportation facility $6,429,000: Build a new operations facility and relocate the following departments to the new facility: transportation, maintenance, child nutrition, grounds, shipping and receiving, including offices, shops, warehousing, fueling, bus wash and parking.

New Career and Technology education (CTE) Facility $27,092,000: Build a new CTE facility to replace the current CTE facility, with new classrooms and shop spaces for the 14 career programs offered by Chapel Hill ISD.

Renovations at Kissam Intermediate $2,622,000: Renovate the current library space to allow for the construction of a new campus entrance with enhanced safety and security features. Build a new and improved parent pickup driveway featuring improved traffic flow. Renovate administrative offices to house a new 21st-century media center.

New classrooms and renovations at Wise Elementary $6,123,000: Build six new classrooms connecting them to the main building to enhance the safety and security of the campus. Renovate the gym to expand its capacity and upgrade student restrooms and storage. Renovate the school entrance and administrative offices with a secure entryway and waiting room.

New classrooms and renovations at Jackson Elementary $5,948,000: Build six new classrooms connecting them to the main building to enhance the safety and security of the campus. Renovate the gymnasium to expand its capacity and upgrade student restrooms and storage.

New multipurpose activity Center $12,180,000.00: Build a multipurpose facility to provide accessibility for district programs to utilize. The proposed plan would accommodate the continued growth in extracurricular activities, fine arts programs, and service over 500 student athletes.

What’s the projected timeline?

“According to architects, the projected start window for the projects is six to eight months after the successful passage of the 2022 bond,” Dean said. “Actual construction will take approximately 12 to 18 months depending on the project.”

What happens if the bond does not pass?

“If the passing of the bond is not successful, large scale construction and improvements, such as the projects proposed in the CHISD 2022 Bond will not be made,” Dean said. “Chapel Hill ISD will continue to follow its regular maintenance schedule to update facilities as funding allows.”

Bullard ISD

Amy Pawlak, Bullard ISD spokeswoman, explained details about the two propositions the district has proposed.

How will the bond affect the tax rate if it is passed?

“If both propositions pass, district homeowners would see a school tax increase of approximately $4.79 a month (based on a $100,000 home and the projected passage of a new $40,000 homestead exemption),” Pawlak said. “However, there will be no tax increase for taxpayers 65 years of age and older who have applied for and received the ‘age 65 freeze of school homestead taxes.’”

The tax impact of $4.79 for a $100,000 valuation is the same if both Proposition A and Proposition B pass as it would be if only Proposition A passes.

A personal tax calculator and other information related to the tax impact are located on the Tax Impact page at BullardBond.com.

If the bond is passed, what will be built/renovated?

Bullard ISD voters are being asked to consider two propositions:

Proposition A totals $82 million and addresses enrollment growth and campus capacities.

Proposed projects include a new middle school serving 6th through 8th grades, which would be located on district-owned land at the east corner of Highway 69 and FM 2493. Proposition A would also fund renovations to the existing middle school campus, with a goal of turning it into an intermediate school for 3rd through 5th grades, a new addition joining Bullard Primary and Bullard Elementary into one school that houses Pre-K through 2nd grades, and renovations to the high school cafeteria to create more space for students during lunch periods.

Proposition B totals $21 million and funds a new baseball, softball, and tennis complex, along with an indoor multipurpose facility. The proposed new baseball, softball, and tennis complex would include parking, restrooms, and concessions. The goal is to locate the complex on land closer to the high school in order to increase safety and ease of access for student-athletes and coaches. Additional proposed projects in Proposition B include an indoor multipurpose facility. The space would provide an approximate 60-yard surface accessible to all student groups, such as band, drill team, sports teams, physical education classes, and more.

Should the bond propositions pass, a design process will begin for each project, soliciting stakeholder input.

What happens if the bond does not pass?

“Bullard is growing, and Bullard ISD is growing with it,” Pawlak said. “If the bond does not pass, the district will have to take a reactive approach to address campus capacities using available M&O funds, instead of voter-approved I&S (bond) funds. This means the district will need to purchase temporary or portable buildings to add learning spaces to accommodate student growth.”

What’s the projected timeline?

“If the bond passes, projects are anticipated to be complete in time for the start of the 2024-25 school year,” Pawlak said. “A design process would begin immediately, soliciting stakeholder input on each project before construction begins.”