Tyler recreates its downtown reinvestment zone after poor performance

Published 5:46 pm Wednesday, September 28, 2016

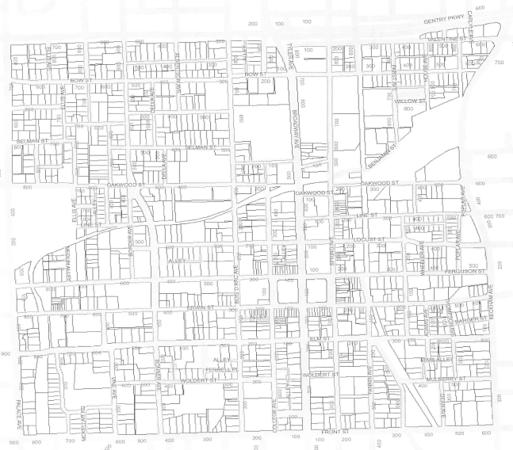

- Map showing the boundaries of the Tax Increment Reinvestment Zone No. 4. The done encompasses 384 acres. Its boundaries are from Gentry parkway to the north, Front Street to the south, Beckham Avenue to the east and Palace Avenue to the west. Courtesy of the city of Tyler

An underperforming downtown tax reinvestment zone was reformed on Wednesday, allowing the city to capitalize on growth and improve infrastructure.

Reinvestment zones involve snapshotting the property tax value on an area and capturing money from any increased value above that threshold into a fund, which can be used for improvement to the area or to help spur development in an underdeveloped or blighted area.

Cities are permitted to use the economic development mechanisms, while counties are not.

The downtown reinvestment zone No. 2 was abolished in March, and the city began rebuilding it in April.

With a 30-year term, the reinvestment zone is estimated to capture $27.6 million over its life, assuming Smith County and Tyler Junior College agree to participate in the plan and put their share of taxes into the fund. Councilmembers acknowledged the revenue estimate set by a consultant might be optimistic.

On Wednesday, the City Council approved an ordinance re-establishing that same 382-acre zone as the Downtown Reinvestment Zone No. 4. The ordinance also established the boundaries of the area – with Gentry Parkway to the north, Front Street to the south, Beckham Avenue to the east and Palace Avenue to the west. The zone could not maintain the same name after its recreation, and will now chronologically follow Reinvestment Zone No. 3, which is in the north Chase area, along north Broadway Avenue.

Potential projects to be used with the captured funds include water, wastewater and drainage improvements, as well as upgrades to streets, lights and park facilities within the area. The funds also can be used as grants to developers for projects.

Mayor Martin Heines said he was in favor of only using the funds for infrastructure projects but said future board members could opt to offer those incentives at its discretion.

“I don’t want to see this (used) as an economic development tool, other than spending the extra money that would come in from the development on things like lighting and sidewalks,” he said, adding the only half-cent sales tax project completed downtown was the Fair Parking Garage. “There is so much that needs to be done around downtown. … I’m not looking for it to be a financing tool, even though it’s allowed.”

The zone will be overseen by a board of directors, which will be chaired by the mayor and will allow a space for representatives from Tyler Junior College and Smith County.

The board of nine or 10 members includes seven appointed by the mayor and confirmed by the City Council. For the city, councilmembers will likely take the remaining six seats held by Tyler. Up to three additional positions may be appointed by the other taxing jurisdictions, if all three participate.

The zone was created in 2008, just before the Great Recession. Since then, many properties in the area went nonprofit and off the tax rolls, causing values to go below the established baseline. No money, therefore, was captured from growth.

There were several properties that contributed to the value decrease. The city purchased the Liberty Theater and was gifted the Fair and Lindsey buildings, taking them off the tax rolls. The county purchased numerous properties downtown, and the Moore Grocery Lofts went nonprofit.

The Fair and Lindsey buildings have since been sold and are back on the tax rolls, and a new brewery is coming into the vacant Expert Tire building.

The city hired Fort Worth-based economic developer David Pettit for $32,000 to help with the re-establishing process.

With the approval of the ordinance, the city will now approach Tyler Junior College and the Smith County Commissioners on whether the jurisdictions would join in on the reinvestment zone. It would be up to the individual boards if they joined, for how long and what percentage of tax funds each is willing to forego as part of the zone.

Both participated in the downtown zone created in 2008.

Twitter: @TMTFaith