Tyler City Council members sign pledge to dedicate 1-cent of tax rate increase to road improvements

Published 1:05 am Thursday, September 15, 2016

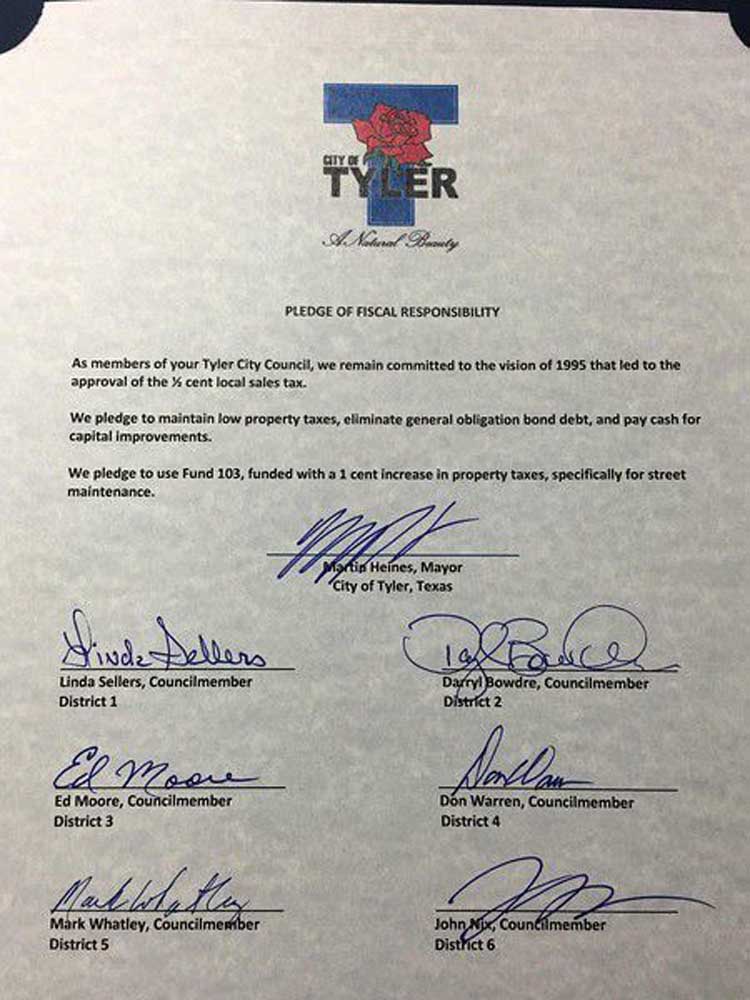

Members of the Tyler City Council signed a formal pledge promising to dedicate a penny of its tax rate to road maintenance.

On Wednesday, the City Council approved its 2017 fiscal year budget.

The budget includes a tax increase from 22 cents to 23 cents per $100 property valuation. The extra penny will be dedicated to road maintenance projects, specifically seal coats and sealing cracks in roads. Asphalt overlay projects will continue to be funded though the half-cent sales tax fund and not through the general budget.

The funds collected through the 1-cent increase will get their own fund, No. 103, or the Street Improvement Fund – and will only be used for such road repairs.

Council members signed a three-sentence formal pledge after their regular meeting Wednesday after they unanimously voted to adopt the budget.

“As members of your Tyler City Council, we remain committed to the vision of 1995 that led to the approval of the 1/2-cent local sales tax,” it reads. “We pledge to maintain low property taxes, eliminate general obligation bond debt and pay cash for capital improvements. We pledge to use Fund 103, funded with a 1-cent increase in property taxes, specifically for street maintenance.”

In its first year, the additional tax is expected to generate about $663,000, and will pay for 32 lane-miles of roadwork.

“Over 20 years ago with the half-cent sales tax, we set aside and earmarked that money,” Councilman Mark Whatley said. “We have all seen and benefited from that over the years, and I’m looking forward to what Fund 103 will do for our streets. It’s a never-ending process to maintain our streets, and I see this fund being used much like the half-cent sales tax.”

Like the half-cent sales tax fund, Fund 103 has the potential to affect all residents driving in the city.

“This is not a thing that will go away,” Whatley said. “(Road maintenance) is an ongoing process, and this fund will reach way out into the future and hopefully keep our infrastructure where it needs to be.”

WATER RATE INCREASE

Council members approved a rate increase for Tyler Water Utilities water and wastewater customers as part of its budget. The increase is estimated to be $8.40 monthly for the average customer with a household usage of 10,000 gallons.

Those funds will be used for capital projects. Mayor Martin Heines said the goal is to use 15 percent of the department’s annual revenue for projects.

“That will be an incredible goal to reach for us, and I dare say we are one of the few municipalities in the state to reach that goal,” he said. “Utilizing cash is so much better than debt.”

Over the next 10 years, the city anticipates spending $96.9 million on 100 projects to improve its wastewater systems.

BUDGET DETAILS

The $138.2 million budget includes:

• A 1-cent increase in the city’s tax rate, from 22 cents to 23 cents per $100 property valuation, which will be allocated to a fund for road improvements.

• A projected 2.5 percent increase in sales tax revenue, which officials admit is optimistic.

• Purchase of 71 WatchGuard digital cameras for its police cars to replace older equipment. It will be the first year of a three-year lease to purchase them, with a cost of $139,703.

• $25,400 toward a matching fund for the Children’s Park of Tyler to help expand the park. The city will utilize a federal block grant to make improvements to Stewart Park.

• Library roof repairs estimated to cost $45,000.

• Four full-time positions in solid waste, including a welder, two recycle laborers and an account specialist. The move is budget neutral. The positions were filled by a temporary agency. The fees once paid to the temporary agency will cover the change.

• A new code enforcement office for an annual cost of $40,935.

• A new fee of $250 to open a grave at the city’s cemeteries. That is estimated to bring in $25,000. A new columbarium at Rose Hill Cemetery is estimated to bring in another $52,000.

• Various improvements to Harvey Convention Center will cost $34,500. Roof repairs at the Goodman-LeGrand Museum will cost another $11,000, and the city plans to spend $605,900 on the Rose Garden, including improvements to the actual garden and creating a master plan for the area.

• Exclusion of any merit pay increases, which were up to 2 percent last year for employees with positive performance evaluations. However, police and firefighters will continue to see step pay increases for years of tenure but will not receive any other increases.

TWITTER: @TMTFaith